Disclaimer: I received a FREE copy of this product through the HOMESCHOOL REVIEW CREW in exchange for my honest review. I was not required to write a positive review nor was I compensated in any other way. All opinions I have expressed are my own or those of my family. I am disclosing this in accordance with FTC Regulations.

It has been my pleasure, as part of the Homeschool Review Crew, to review Personal Finance Lab’s Budgeting and Stock Market Game with Integrated Curriculum.

This online game uses real life scenarios to see if your student can increase their savings, credit score, and ultimately their monetary portfolio.

Along with the game, there are integrated lessons to help your child learn while they’re having fun.

So many great options to get set-up for Personal Finance Lab’s Budgeting Game

Once you have paid for the game and logged in, you can follow the step-by-step instructions to set up the Budget Game.

At first you set up your settings for the challenge. You give your budget game challenge a name and password, if you want to make your stats public or share them.

I named our challenge, “Who wants to be a Millionaire?”

Here is where you enter how many people will be playing in this challenge, the start/end date, and if you want your players to be able to gather special badges and printable certificates.

Set-up Expense List for the Budgeting Game

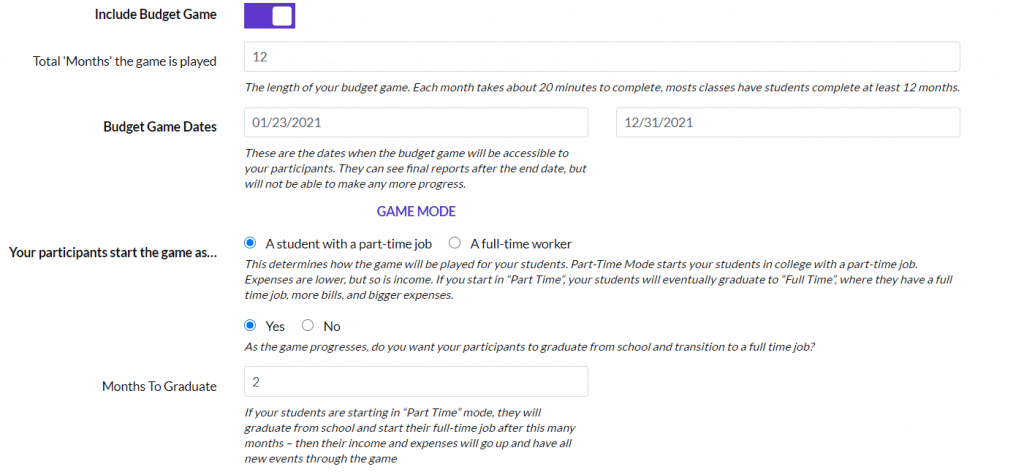

Before you begin playing, you still have to set up other budget game parameters.

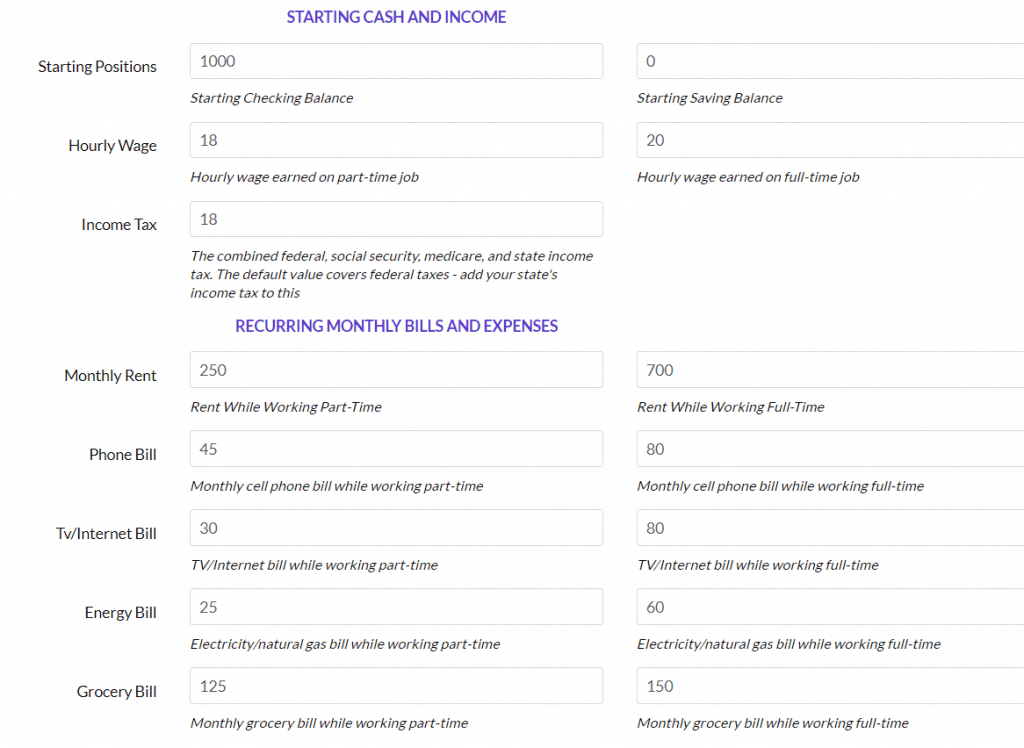

For instance, you choose how many virtual months you want your kids to play, how much money they get to start out with, their hourly wage, tax fees, rent, phone, internet, energy, grocery, car payment and insurance amount, and gas expenses.

You could have your kids do the homework of having to figure out these amounts from your own personal bills/debts, or from the community around them (gas prices, rent, etc.)

Any of it is changeable, or you can leave everything as default.

Set-up Your Living Scenario for the Budgeting Game

You also choose if you want to highlight any real life events. You can choose to have more “bad” events happen in certain areas, or just keep them as default so that all life event areas are emphasized equally.

Life events are risk/insurance questions (buy or not buy), investing, charities, taxes, household, and contracts.

For my challenge, I chose to start us all off as full-time students working a part time job. With this scenario, I felt I’d give my kids a glimpse into both the full-time student world, and then the full-time worker. All of it is customizable, if you want your challenge to start with full-time workers.

Again, you as the administrator get to choose the monthly income, monthly expense amounts and variable expense amounts.

Also, you can choose when each of your players will graduate from school. I chose to have my kids graduate after two virtual months. Any of it is customizable or you can leave it all as the default settings.

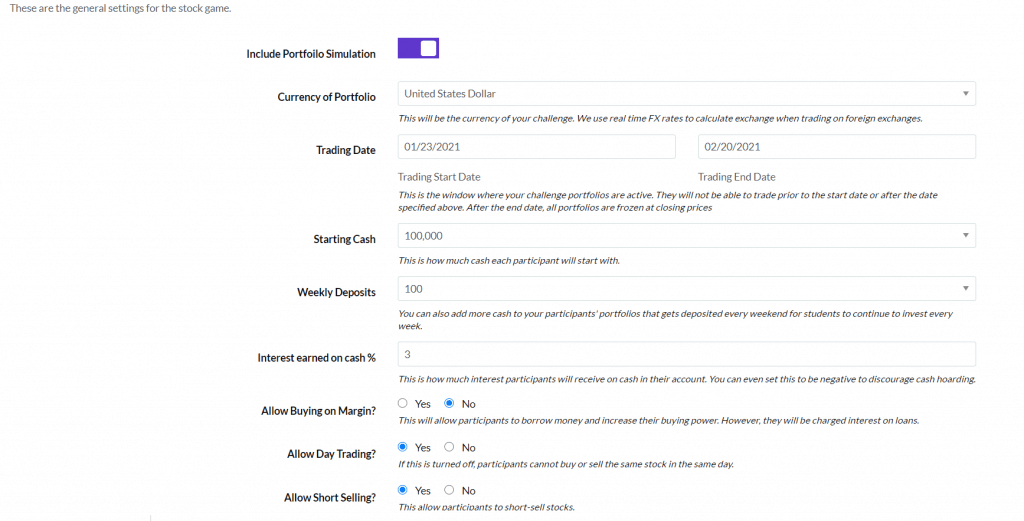

Next I chose to include the stock game into our challenge. This was the hardest part of the challenge for me, because I don’t know (or I didn’t know) about the Stock Market.

Set-up the Stock Market Game Parameters

You have choices here too, or if you’re like me, just keep this stuff you don’t know about, as default settings.

These questions include: allow short selling?, allow day trading?, trade notes required?.

You also get to choose the security types. Equities, stocks, options, mutual funds, bonds, futures, future options, forex, and cash spots. ( I know, it gets deep, right?) Just don’t let it overwhelm you, keep the default settings.

Then you can choose the places where your exchanges take place. Do you want to keep it just as the U.S., or would you like to choose countries in Latin America, Europe, or Asia?

Parents/teachers that already have some knowledge of the Stock Market will be able to individualize their settings for their challenges a lot better, but I just kept it default. (As I have said)

Choose the Lessons for Learning During the Budget and Stock Market Game

Now you can customize your child’s dashboard with all sorts of cool widgets. You can have your child see a “word of the day”, stock game rankings (weekly/monthly), budget game rankings, DOW Finance Wall, and so much more.

Not only do your kids just play a game, they can do lessons too.

You can create assignment lists and due dates for each one.

There is a TON of lessons to choose from. These lessons are included as the game is played, or you can do the assignments whenever it suits.

First I looked at the Personal Finance Lessons.

These lessons include:

1. Student loans

2. Compound interest

3. Investment returns

4. Building wealth

5. How to save to be a millionaire

6. Home budgeting

7. Credit card payments

8. Buy vs. Lease

9. Car loans

10. Net worth

11. Financial records

12. Keeping or tossing receipts

13. Contracts

14. Banks, credit unions, and savings and loans

15. Reconciling accounts

16. Credit cards/debit cards

17. Preparing for retirement

18. Credit reports

19. Protecting against fraud

20. Mortgages

21. Sales tax

22. Car/home/life/health insurance

23. Good debt/bad debt

24. Starting a business

25. Soooo much more!

Secondly, I looked at the Career Prep Lessons. They include:

1. Certifications in the finance Industry

2. Choosing an internship

3. Job interviews

4. Keywords in resumes

Third, was the Stock Game (Beginner Lessons). These lessons included:

1. What is a stock?

2. Understanding stock quotes

3. Why invest?

4. Getting trading ideas

5. Trading stocks

The Elementary/Middle school lessons for the stock game were good too. They include:

1. What are mutual funds?

2. What are bonds?

3. What is the Stock Exchange?

4. What is a Stock Index?

5. How to build a portfolio

Along with those sections of lessons, there are intermediate stock lessons, economic lessons, spreadsheet lessons, accounting and marketing lessons, investing 101, Investing: Basic Trades, Investing: Order types, Investing: International Investing, and then Options and Derivatives with investing.

The lessons are text only or you watch videos. You can decide how many tries your child gets if they don’t answer the questions correct at the end of the lessons.

On the teacher/administrator dashboard you can see who, how much, and which of the lessons are completed.

Play Time with the Budgeting Game

After you get all that set up, you can look at your dashboard. You have two to choose from. Either the instructor dashboard or the student view dashboard.

If you play along with your kids, you’ll want to switch to the student view, and if you want to start with the Budget Game, then make sure that is clicked. You’ll have a little scenario to read and then questions to answer to get your playing started.

Your child chooses what kind of housing they want. Do they want a small place or a larger place with roommates? How about the internet? Do they want the best and fastest or do they want a limited data plan?

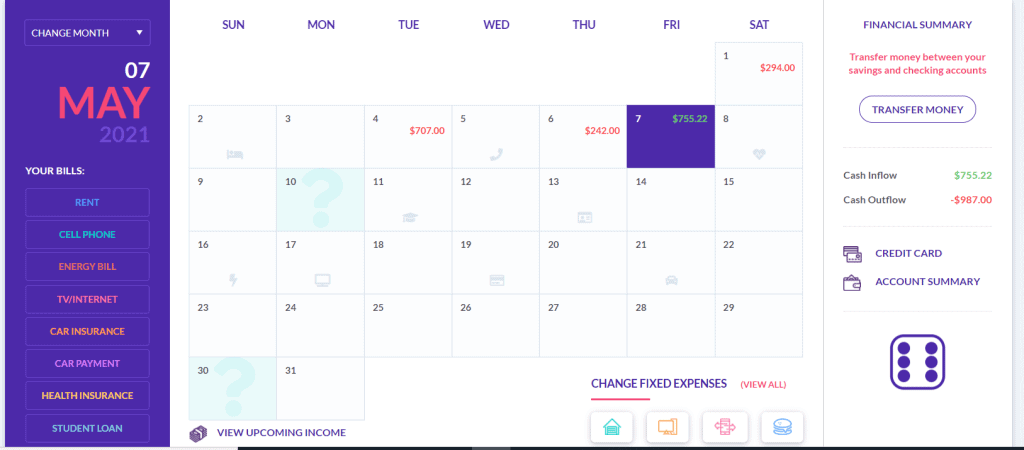

After the initial “getting settled” questions are finished, the game leads you through your weekly/monthly deposits and your expenses. It gives you the opportunity to decide how much of your paycheck you want to save each week. All you have to do is remember to transfer those monies to your savings account!

After the questions, you see the first calendar month on the screen. You click on the dice to roll it, and the computer moves you ahead on the calendar. Most days there is something happening.

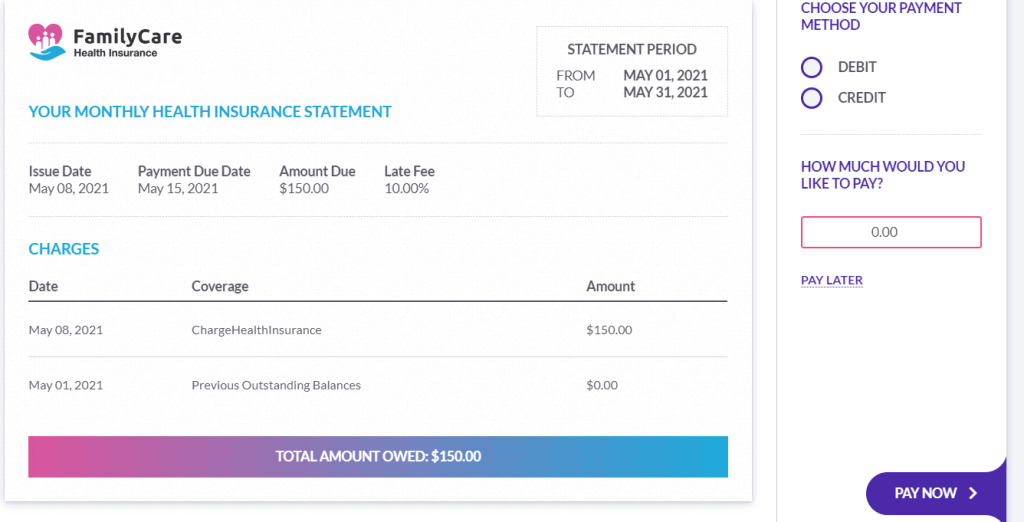

If it’s something bad, like your cell phone screen cracked, then you have to decide if you’re going to get it fixed or just use it the way it is. If you decide to get it fixed then you have to decide if you want to pay the fee with a debit card or credit card.

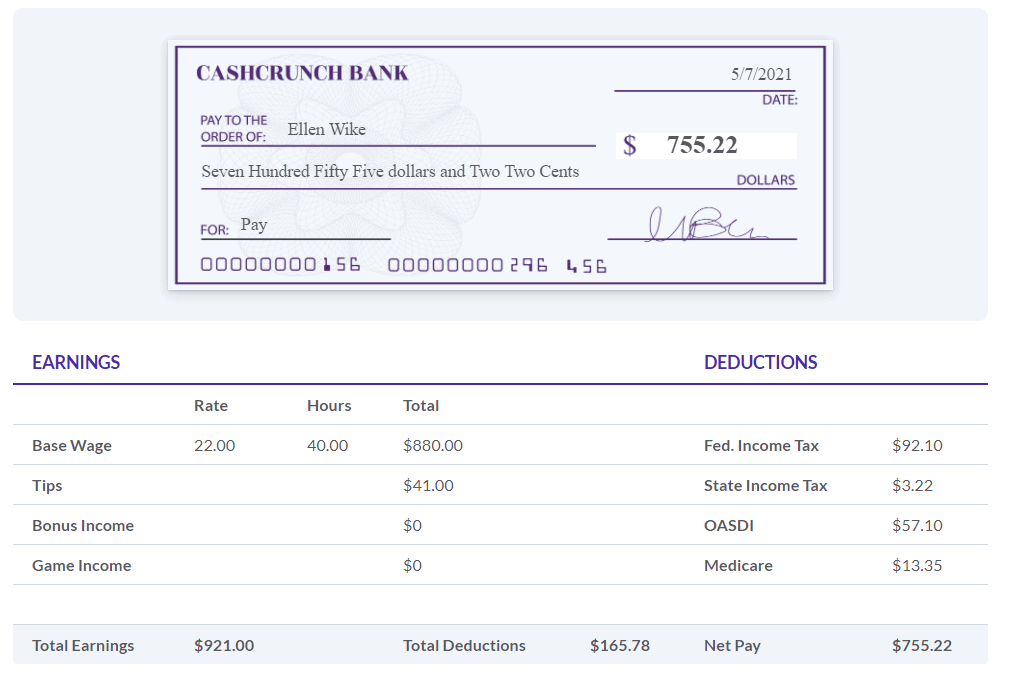

Sometimes there are good things that will happen, so it’s not always bad. Every Friday is payday! It shows the child what their paycheck really looks like, with their information on it.

On the calendar are little icons that represent when a bill is coming due. You have a week to pay it. If you forget to pay it, then you’ll have to pay the extra fees.

Every weekend you get to decide if you want to study, work extra hours, do household chores, or socialize.

Studying can get you a raise, working the extra hours helps your paycheck, household chores can save on expenses, and socializing causes you to spend money.

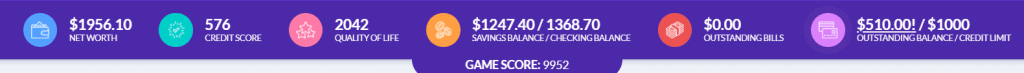

The idea of the game though is to have a good score with your quality of life (socializing or buying nice things), increase your savings account amount, increase your credit score, and increase your net worth. So the weekends give each player a chance to increase in each area of their playing lives.

My fifteen year old daughter loves the Budget Game. I actually have to tell her to quit playing, because she would sit there all day! In my family, she is in the lead, but she does have more virtual months completed than the rest of us.

My eighteen year old is more interested in other things. She has her own checking account and gets paid for working, pays for gas and real-world stuff like that. The game for her was more of a chore.

I enjoyed the Budget Game a lot. I thought it was fun sitting beside my fifteen year old, each with our own laptop, and playing beside each other. One or the other of us would yell out occasionally if something bad happened and we would lose money.

Buy Your Stocks for the Stock Market Game

When you click on the Stock Game, you enter a more confusing world, in my opinion.

I had to watch the video tutorials on what I was looking at and what we had to do. Once I got a basic knowledge of how to start then I could explain it to the kids.

We each had $100,000 to invest in the Stock Market. We didn’t get into bonds and Mutual stuff.

Once I figured out how to search for different types of companies, me and the kids each sat with our laptops and searched away.

We were surprised at some of the results we got. For instance, I assumed that a name brand home supply store would be a good investment, but when I pulled it up, the graphs and stats showed it was down a good bit. So I skipped that brand.

I was impressed with the kids being able to come up with or find good investing opportunities.

One or the other of them would yell out to the rest of us, that such-and-such place is doing really well. So then we’d all look that place up and choose how many stocks we wanted to buy.

The kids didn’t buy a lot of stock at one place. It really took a long time for them to invest their $100,000. They ended up just putting in some alphabet letters and seeing what kind of company names came up. After a while, you just run out of business/company names.

We had some good discussions about the types of places that were good investments. It was interesting to hear their opinions.

Each day when you go into your dashboard, you can see how your stocks are doing. Your results are based on the real Stock Market, in as close to real time as is possible. That is really cool.

If your stock is not doing well in one company, you can sell it, and put it somewhere else.

I think the Stock Market is still over my head, but it is really fun to invest virtual money. If you lose it, then well, you lose it!

Conclusion for Personal Finance Lab’s Budgeting and Stock Market Game

Personal Finance Lab’s Stock Game and Budget Game are both very detailed, educational, and eye-opening.

I would highly recommend these games for any family. There are plenty of video tutorials to explain things, and I would highly recommend starting there to help you get your challenge set up.

A big thank you to Personal Finance Lab and the Homeschool Review Crew for allowing me to use this product and write a review. I learned a lot!

Follow Personal Finance Lab on Social Media

Facebook: https://www.facebook.com/personalfinancelab/

Instagram: @pfinlab / https://www.instagram.com/pfinlab/

YouTube: Stock-Trak – https://www.youtube.com/channel/UC1bctfGzsS_YVQT1MGMRIGQ

More Reviews Available!

If you would like to see what other homeschool bloggers had to say, here is the best place to go.